European equities: Strong positive earnings revisions

The global stock market powered ahead in April to new historic highs. Both the very strong Q1 results and the continuously dovish Fed stance helped take stock markets to unchartered territory. In many regions of the world, the COVID-19 pandemic’s coming under control, thanks to massive vaccination campaigns, has clearly added to investors’ optimism. This evolution has made many optimistic about a strong economic recovery. Combined with the still-accommodative stance of most central banks, inflation numbers are being closely monitored, with some upward pressure on long-term interest rates.

European equities closed April up. European countries have struggled to varying degrees to get on top of recent COVID-19 outbreaks, but cases in the region are heading in the right direction. The welcome acceleration in the vaccination rate makes us confident that the economic recovery can begin in earnest in the second quarter, with peak growth expected in Q3 as restrictions loosen.

In EU countries, while the current wave is receding in hospitals, spare capacities are thin. 25% of the EU population have received at least one dose, and 10% is fully vaccinated. At the current pace, 70% of the population should be vaccinated by October 2021.

The Eurozone economy contracted by 0.6% in the first quarter, but, despite the measures needed to contain the virus, there were signs in April that the economy was beginning to grow again. With a return to normality in sight, consumers are feeling more optimistic and April’s confidence indicator rose more than expected. Spending also proved resilient through the difficult winter, with retail sales for February just 2.9% lower than a year ago.

Inflation remains more muted in the Eurozone than in the US. Estimates for April showed that headline inflation rose to 1.6% YoY but that the core measure remained subdued, at 0.8% YoY. European Central Bank president Christine Lagarde indeed acknowledged that the Eurozone and the US were on different pages when it came to the economic and inflationary outlook and, as such, the ECB would not be acting in tandem with the Fed – a nod that the tapering of its bond purchases would likely be slower. The Eurozone is now clearly lagging the US economy.

Despite a weak H1 2021, we expect GDP to grow by 4.6% in 2021 and therefore be close to trend by year-end. While delayed, the recovery should gather steam in H2 as most of the population should be vaccinated. Moreover, excess savings and strong disposable income in most of the EU countries as at end-2020 should support the recovery once social distancing eases.

The strong positive earnings revisions in EMU during Q1 2021 were in line with the ongoing normalization of the economy. These upward revisions were partially anticipated by the market, as Europe is lagging the US in its recovery. In a sense, these good results seemed to confirm the market rally, rather than act a catalyst for further upside.

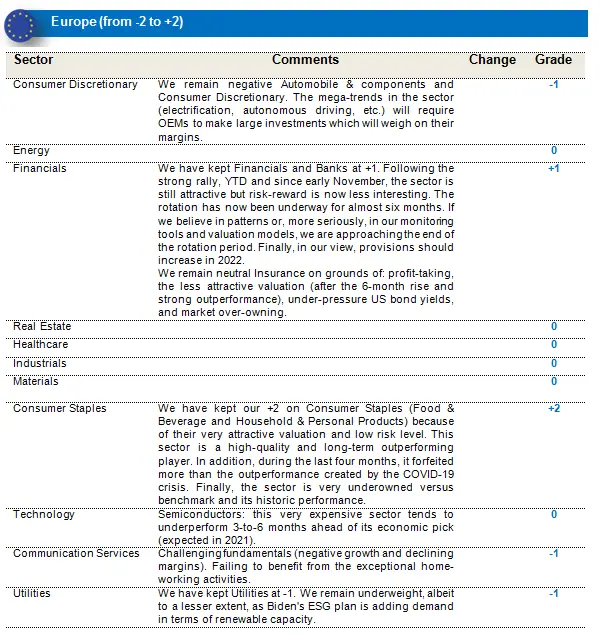

Based on our matrix ROE vs. P/B, sectors such as Financials and Consumer Staples are still attractive. On the other hand, Consumer Discretionary, Industrials and IT seem to be particularly expensive, a sign that the Cyclical rotation is now closer to its end.

In terms of sectors, Materials, Consumer Staples and Financials were the best performers. Financials naturally respond to higher yields, while Commodities respond to better growth/demand and are natural inflation hedges. On the other hand, IT, Utilities and Energy were the worst performers, as the month of April continued the Value trend and we witnessed a further unwinding of the clean-tech & IT sectors. Finally, the Energy sector, despite its very attractive valuation, remains underowned by investors, probably due to the structural challenges facing it

Since the last committee, most of our grades have paid off, our best contributors being our underweight on Automobiles & Components. In our view, valuation levels are far too high (rotation for 6 months already) and mega-trends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments which will weigh on their margins. As a result, we cannot justify valuations close to pre-COVID-19 levels. On the other hand, we lost out from our underweight on Luxury Goods.

Despite volatility on the stock market, our positioning will again favour the growth/quality investment style in the coming months, by capitalising on more attractive valuations. We will look for economic segments that are set to accelerate in the coming years, against a backdrop of new regulations (ESG or otherwise) and innovation. Finally, value is the pain trade now, with rotation already underway for almost six months now. If we believe in patterns or, more seriously, in our monitoring tools and valuation models, we are approaching the end of this rotation period.

All our grades remain unchanged.

As a result, we have kept our grades on Financials and Banks at +1. Following the strong rally, YTD and since early November, the sector is still attractive but the risk-reward is now less interesting. This rotation has now been underway for almost six months. Finally, in our view, provisions should increase in 2022.

We have kept our neutral grade on Insurance on grounds of: profit-taking, the less attractive valuation (after the 6-month rise and strong outperformance), under-pressure US bond yields, and market over-owning.

We have kept our negative grade on Automobile & components and Consumer Discretionary. The mega-trends in the sector (electrification, autonomous driving, etc.) will require OEMs to make large investments which will weigh on their margins.

We have kept our -1 on Utilities, following the strong YTD underperformance of the sector. We remain underweight, albeit to a lesser extent, as Biden's ESG plan is adding demand in terms of renewable capacity.

We have kept our +2 on Consumer Staples (Food & Beverage and Household & Personal Products) because of its very attractive valuation and low risk level. This sector is a high-quality and long-term outperforming player. In addition, it forfeited, over the last 4 months, more than the outperformance created by the COVID-19 crisis. Finally, the sector is very underowned versus its benchmark and its historic performance.

US equities: Growth stocks back in the picture

US equity markets closed the month higher. After several months of value outperformance, growth stocks came again to the forefront in April. The US, traditionally more growth-oriented than Europe, clearly outperformed Europe and Emerging Markets.

The USD 2.3 trillion American Jobs Plan is designed to invest in the country’s infrastructure, while the USD 1.8 trillion American Families Plan will aim to ensure a more equitable recovery, with many key tax credits from the Rescue bill being extended or made permanent. The plans outline proposals to increase the corporate, top marginal income, and capital gains tax rates in order to pay for the spending. While the passage of the Rescue plan through Congress was fairly straightforward, these further plans are likely to be more contentious. Compromises will likely need to be made on both the spending and taxation proposals in order for the bills to pass.

With the vaccine rollout proceeding well and COVID-19 cases broadly under control, the US consumer has started to make up for lost time as the economy reopens. Consumers are feeling more confident, having saved, in 2020, about 8% of GDP above what households normally put away, combined with the USD 1,400 stimulus cheques from the Biden administration. The Conference Board’s measure of confidence rebounded sharply, from 109.0 to 121.7, in April.

Most domestic demand components were oriented upwards in Q1. April ISM surveys, although down from very high levels, still pointed to a continuing improvement. The increase in the interest rate since the beginning of the year should gradually put a brake on residential investment, while business investment is expected to show robust growth in the coming months. Workers and input shortages continue to be issues limiting growth in manufacturing activity.

Inflation is expected to increase significantly above 2% in 2021, before reverting back in 2022. With half of core inflation barely linked to the cycle, inflationary pressures are likely to be short-lived.

We expect GDP to grow by 6.8% in 2021 after a 3.5% contraction in 2020. Our scenario foresees most of the population being vaccinated by Summer 2021, allowing a gradual end to social distancing. Fiscal measures are supporting the recovery.

The US is the most expensive region, with an average P/E of 22.5. The area is ahead of Europe, EM, the UK and Japan in terms of economic cycle, thanks to its powerful vaccination campaign.

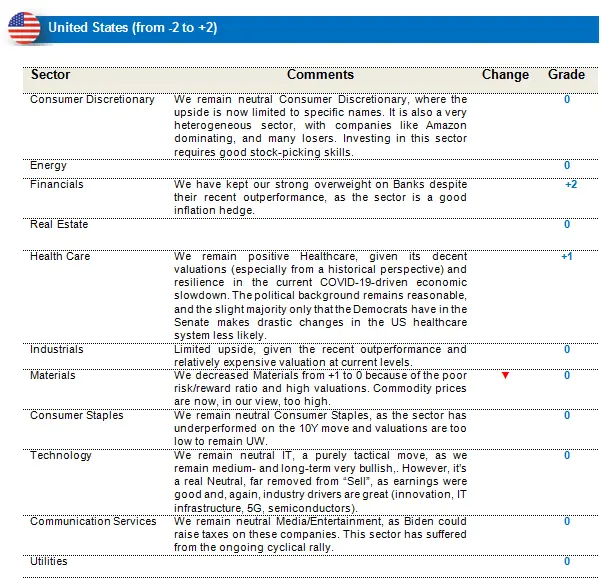

Based on our matrix, ROE vs. P/B sectors such as Financials and Consumer Staples is still attractive. On the other hand, Cyclical sectors such as Consumer Discretionary, Industrials and Real Estate seem to be particularly expensive, a sign that the Cyclical rotation is now closer to its end. Surprisingly, IT seems fairly valued.

In terms of sectors, Energy, Financials and Materials outperformed (good earnings season). On the other hand, IT underperformed. Financials naturally respond to higher yields, while Commodities respond to better growth/demand and are natural inflation hedges. On the other hand, IT, in line with upward pressures on long-term interest rates, underperformed.

Since the last committee, all our grades have paid off, our best contributor being our strong overweight on Banks, supported by upward pressures on inflation and interest rates. Healthcare strongly contributed to our performance, as the sector is rather cheap (P/E) from a historical point of view, despite a mixed earnings season, as the Q1 2020 stocking of drugs because of the pandemic in China created a high base level. Finally, our +1 on Materials also generated a strong outperformance as commodity prices rose.

Despite upward pressures on inflation and long-term interest rates, we are convinced that the outperformance of the Value style is a short-term phenomenon. We are convinced that the Quality/Growth style should outperform in the medium/long term. Value is the pain trade now as the rotation has already been largely consumed.

As a result, we decreased our grade on Materials from +1 to 0. Bad risk/reward, high valuations and commodity prices are now, in our view, too high, with most commodities now above pre-pandemic levels.

We have kept our strong overweight on Banks, despite their recent outperformance, as this sector is a good inflation hedge.

We have kept our neutral grade on IT, as it is still too early to increase our exposure. However, this is a purely tactical move, as we remain medium- and long-term very bullish, but rising 10Y interest rates convinced us to lower our rating in the short term. However, it’s a real Neutral, far removed from “Sell”, as earnings were good and, again, industry drivers are great (innovation, IT infrastructure, 5G, semiconductors).

We remain neutral Consumer Staples, as the sector has underperformed on the 10Y move and valuations are too low to remain UW.

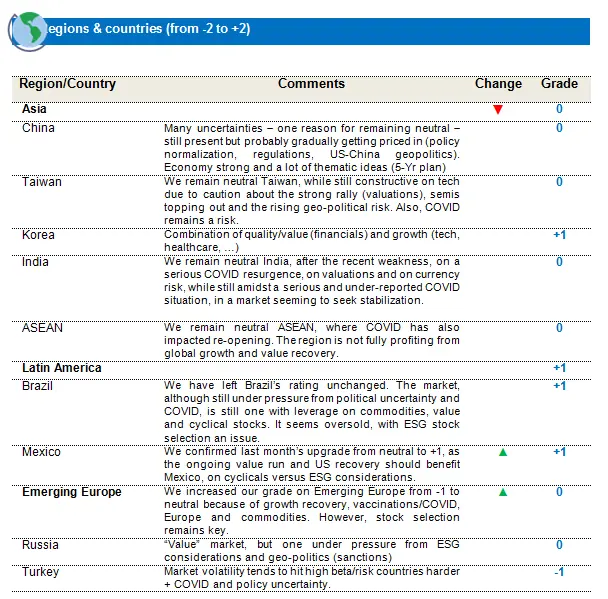

Emerging Markets: Caution prevailing

April was a relatively muted month for EM equities. The benchmark index recovered partially from March to post a 2.4% gain for April as against the MSCI World’s 4.2% return. With US Treasury yields cooling off, the US Dollar’s retracing some of its past gains helped EM performance. However, overall, the EM landscape remained cautious, with a large-scale outbreak of COVID-19 in countries like India, Thailand and Brazil. Nor did the slow EM pace of vaccination back the case for a faster recovery.

Taiwan (+7.7%) was amongst the best markets in April, with the TWSE reaching record highs. Chinese equities regained some ground, posting a 1.3% (US$) return, with strong corporate earnings supporting valuations. India (-1.0%) underperformed, with rising COVID-19 cases raising concerns about a derailing economic recovery. LatAm, posting a +3.2% gain for the month, outperformed; Brazil, too, delivering a +5.8% return, shone, while Chile declined 9.6%, amidst rising political uncertainty.

With the dollar index declining by 2.1%, commodities continued to surge. The S&P Metals Index gained 9.8% for the month, with Iron Ore, Steel, Copper and Nickel all posting double-digit gains.

In terms of strategy, we confirmed our upgrade of last month, this time from Neutral to +1 on Mexico, as the ongoing value run and US recovery should benefit the country, taking into account cyclicals versus ESG considerations.

We increased Emerging Europe from -1 to neutral on growth recovery, vaccinations/COVID, Europe and commodities. However, stock selection remains key. We kept unchanged our grade on Brazil, a market still under pressure on political uncertainty and COVID, but still one with a leverage on commodities, value and cyclical stocks. The market seems oversold, ESG stock selection being an issue. We remain neutral ASEAN (where COVID has also impacted the re-opening), a region not fully profiting from global growth and value recovery. We have also kept our (slightly decreased) neutral grade on India, after the recent weakness, on a serious COVID resurgence, on valuations and on currency risk. With a still-serious and under-reported COVID situation, the market seems to be seeking stabilization. We remain neutral Taiwan, while still constructive on tech, due to some caution on the strong rally (valuations), semis topping out, COVID and the rising geo-political risk.

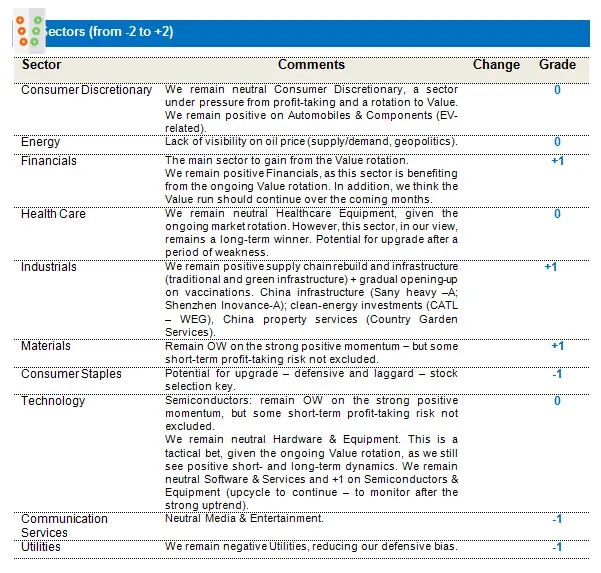

Although we remain overweight (+1) Materials, due to their strong positive momentum, some short-term profit-taking risk is not excluded.

We remain neutral Healthcare. However, there is long-term positive + potential for an upgrade after a period of weakness.

Although we remain overweight Semiconductors & Equipment, based on the strong positive momentum, some short-term profit-taking risk is not excluded.

Finally, we continued to keep a balanced portfolio, combining value/cyclical and ‘opening-up’ exposure, due to quality/growth stocks and sectors (technology, healthcare, CD) somewhat protecting the portfolio from profit-taking on more interest-rate-sensitive and longer-duration growth stocks, which came under selling pressure towards the end of the month. As a result, in terms of styles, we are more balanced between Growth/Value and are reducing the momentum bias as funding source, despite our positive longer-term view.