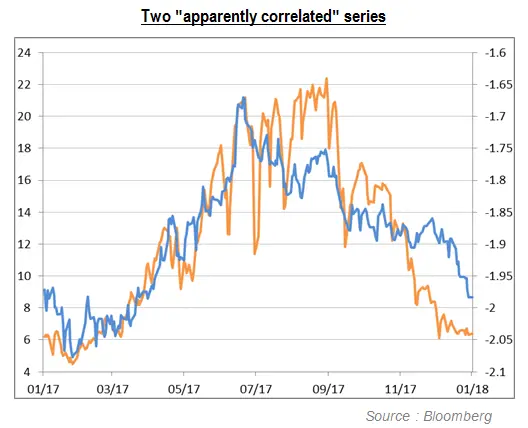

Purists like to distinguish between correlation, co-integration and causality. Quite right, too: just because two series are statistically correlated doesn’t necessarily imply a causal link. The two series below seem to be moving in synch. We would appear to be looking at an "apparent", albeit not significant, correlation (a "spurious relationship", as the statisticians say). See for yourselves: the blue line shows 10Y inflation expectations in the USA as taken from the TIPS (inverted scale), while the orange shows River Rhône temperatures at the Franco-Swiss border.

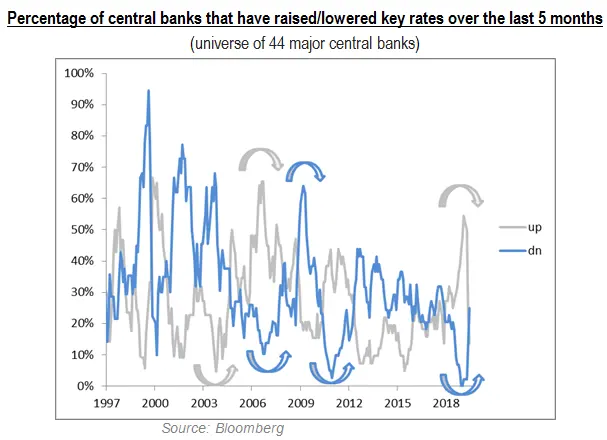

In the space of barely 6 months, central banks have performed quite an exceptional U-turn, replacing their monetary normalisation stance (gradual rate rises) with its polar opposite (monetary easing). What’s going on? It’s very simple: nothing special! Fact: the global growth outlook has been revised slightly downwards, from 3.5% to 3.3%, for 2019 and kept at that same level for 2020. As for the inflation outlook, it remains unchanged. In the light of this, to what do we owe this monetary volte-face?

Let’s revisit this idea of "causality". Many economists agree with the analysis performed by the central banks, believing that lower rates should help economies turn the slowdown into a mid-cycle slowdown rather than an end-of-cycle slowdown. In so doing, they convey the idea that the monetary policy would impact the economic cycle.

We think otherwise. In fact, we believe the opposite is true: economic cycles drive monetary policy, not the other way round.

In a nutshell, it’s a no-brainer. If central banks were as influential as they think, they would smoothen the economic cycle, there’d be no recession and growth would stabilize at an annual 3/4%. But that’s far from the case. The cycle is volatile: in times of low growth, central banks lower rates; then, following a growth spurt, they can re-arm by hiking rates. So, monetary policy is endogenous to the cycle. Only rarely is it exogenous, and then only in cases of extreme systemic risk (1998 and 2008 in the USA, 2008 and 2011-2012 in Europe).

From this point of view, the current period is unprecedented. Although history will be our judge, it may well be that, in a hundred years’ time, we’ll still be referring to it as "the golden era", at least as far as financial markets are concerned, with investors obsessed about the financial support provided by central banks ("addiction" in the true sense of the term, genuine dependency) and central banks obsessed about financial market behaviour (financial conditions).

According to theory, economic growth depends on an adequate institutional framework and sufficiently flexible markets: these ideas seem to have been somewhat discarded, and the drop in the rates by a few points seems much more significant than pension reform in developed countries or the setting-up of ambitious research programmes. Listen up, folks – the next 0.25% drop will prove earth-shattering!

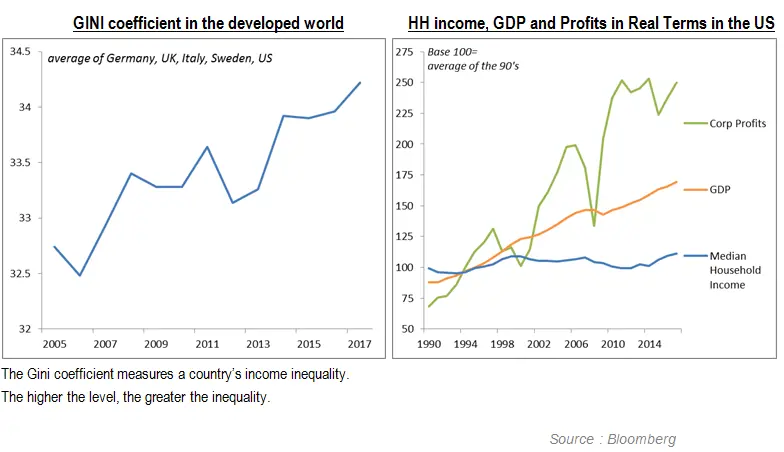

These policies of supporting financial and real estate assets at all costs have heightened inequalities within companies, pitting asset holders against the rest. Although central bankers strongly feel that, by helping the wealthy, you help the poor, the emergence of social crisis throughout the world, despite a record low unemployment rate, contradicts this claim. The trickle-down economics approach rules. But until when?

If rates were less accommodating, governments would be under greater pressure to better manage the public purse and to substantially raise the taxes on businesses and on the most affluent households. The zero interest-rate policy is having the opposite effect as well as engendering an unprecedented moral horizon: why on earth should the French government tighten the purse strings while, thanks to the central bank, the government is paid interest if it gets into debt?

The latest central bank communiqués show that their mental health is now part of their reaction function. Their decision-making is clouded by their fears. The next rate drops have to be seen in this light: rates go down because central banks are afraid (non-objective view of the glass half empty).

What follows next is the more explicit monetisation of the public debt (even in Europe!), and even the targeting of equity indices (the Japanese government, in the wake of its share buyback programme, now has a market share of almost 5%).

It’s futile to think that monetary policy can cure the world’s economic ailments. Central bankers, although only too well aware of this, remain tight-lipped on the matter: "It is what it is." Here’s an extract from the transcript of the Q&A that followed the latest FOMC (June 2019):

QUESTION: Michael McKee, Bloomberg Television and Radio. If consumer spending is solid and business investment has been slowed by uncertainty, I'd like to get your thinking on what a Fed rate cut would do. Have you modeled the additional growth and inflation you might get from a rate cut? Can you identify any sectors that would benefit from a lower cost of capital? Or is this really about the Fed being the only game in town?

POWELL: Well, we -- we have the tools we have.

What an admission! as – at the risk of repeating ourselves and without the benefit of hindsight with which to accurately interpret the signs – this monetary leap betrays very worrying signs of growing inequalities between asset holders and the rest. Not forgetting that it also distracts governments from effectively managing the public finances.

How, then, will it all end? We don’t really know. Nor do we see any reason for it coming to an end in the foreseeable future. As inflation is no longer a risk ((which, indeed, has been the case for quite some time now), rates won’t rise. But how far down will they go? At the time of writing, the 2Y Swiss is about to hit -1%. How big a drop there will be is anyone’s guess and we could witness a -2% or -3% rate by the end of the cycle. The investment risk is of the classic "loss of confidence" variety. A loss of confidence on the part of private economic agents would prompt a recession and/or loss of investor confidence in this "system" that would usher in a collapse of the currencies of the countries that have most abused public finance monetisation (with the Japanese yen most at risk).

And what about the populist risk? Populism represents a risk to the very well-off as it raises serious questions about this system and its original trickle-down economics ideology. Movements such as Occupy Wall Street in 2011 and the more recent "Gilets Jaunes" in France have so far been quite marginal and seem to be the last thing on the minds of the powers that be (including central banks and governments); what’s the betting such movements proliferate as the need for social justice and environmental action becomes more pressing? Eventually, and unless the requisite steps are taken, the next rate reduction should be more than just relatively important – as should always have been the case, no?

Tristan Abet

The comments and opinions expressed in this article are those of the authors and not necessarily those of Candriam.